Exploring Opportunities with International Banks for Sale: A Strategic Guide for Modern Investors

In today’s rapidly evolving financial landscape, the acquisition and sale of international banks for sale represent a compelling avenue for savvy investors, financial institutions, and business conglomerates looking to expand their global footprint. As the world's economies become more interconnected, the strategic ownership of banking entities across borders offers unmatched opportunities for growth, diversification, and competitive advantage. This comprehensive guide explores the intricacies, benefits, and strategic considerations associated with purchasing international banks for sale, empowering investors with the knowledge to make informed decisions in this lucrative sector.

Understanding the Significance of International Banks for Sale in the Global Economy

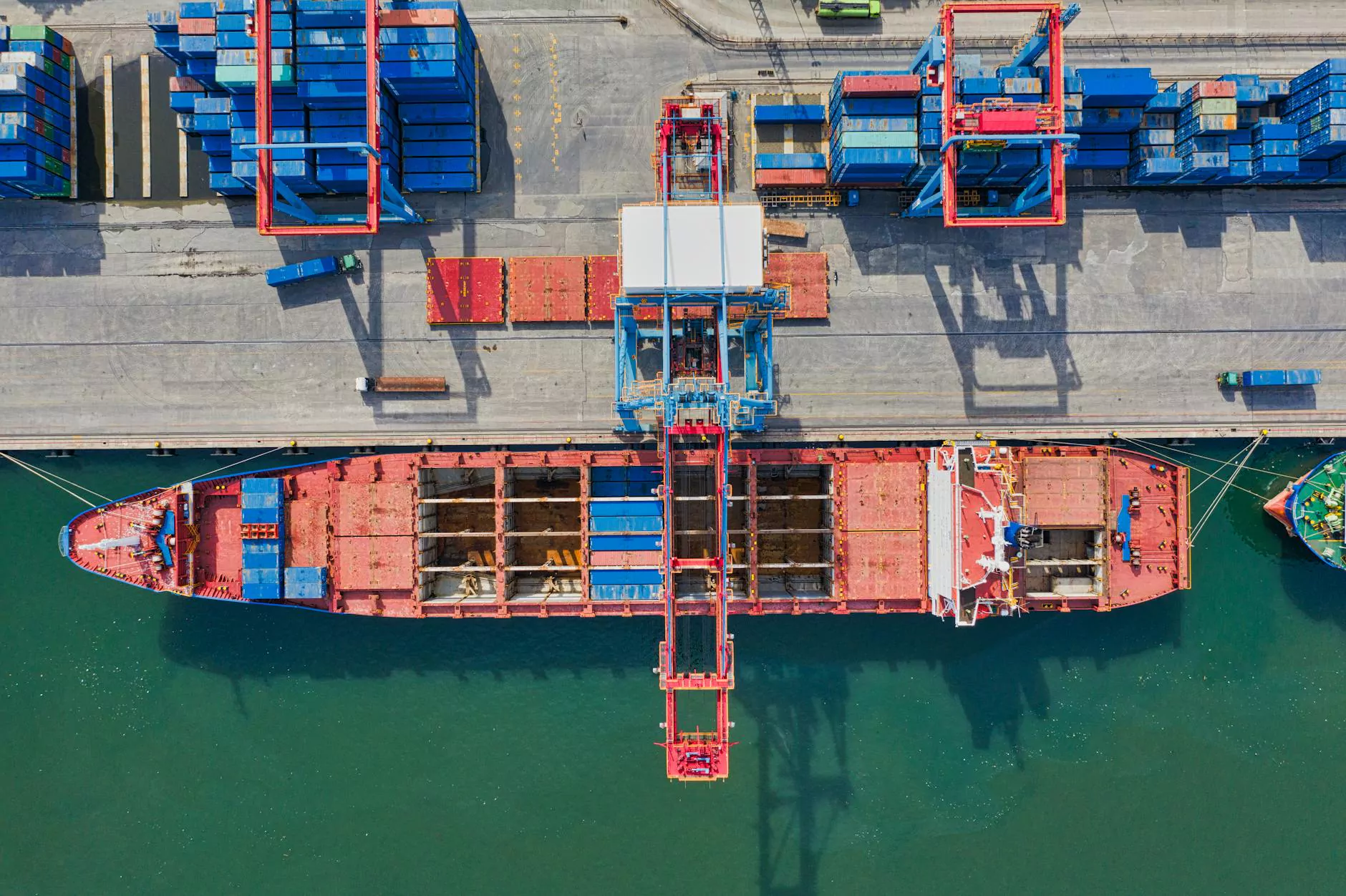

The concept of international banks for sale is at the heart of the modern global financial ecosystem. These banking institutions serve as critical intermediaries facilitating international trade, investment, and capital flow. When these banks become available for acquisition, it signals a unique opportunity to tap into emerging markets, diversify risk, and leverage established financial infrastructure across multiple jurisdictions.

Investors and financial conglomerates are increasingly eyeing these opportunities due to several compelling reasons:

- Market Expansion: Acquiring a bank in a new geographical market opens doors to new customer bases and revenue streams.

- Strategic Diversification: Exposure to different economies and regulatory environments reduces dependence on localized markets.

- Enhanced Competitive Edge: Owning a bank with established brand and operational strengths boosts overall market power.

- Access to Capital: International banks often facilitate easier entry into global financial transactions and investment channels.

Key Considerations When Evaluating International Banks for Sale

While the prospects are promising, navigating the world of international banks for sale requires meticulous analysis and strategic planning. Prior to acquisition, investors must undertake due diligence that covers legal, financial, operational, and regulatory aspects.

Legal and Regulatory Frameworks

Different countries operate under distinct banking laws and regulatory standards. It’s essential to understand:

- The jurisdiction's banking license requirements

- Anti-money laundering (AML) policies

- Capital adequacy ratios mandated by regulators

- Foreign ownership restrictions and repatriation policies

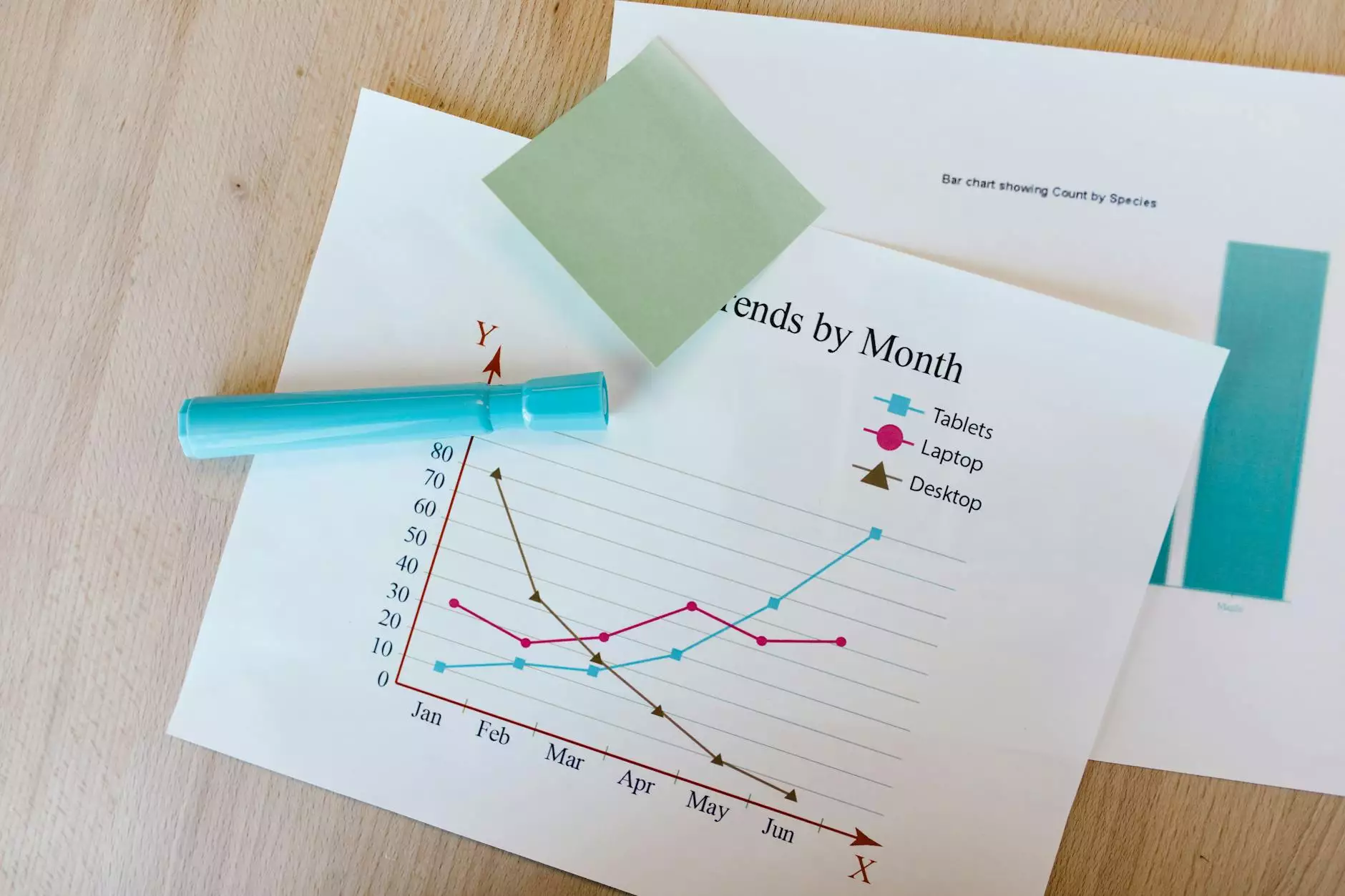

Financial Health and Performance Metrics

Assessing the financial stability of a prospective bank involves examining:

- Balance sheet strength

- Loan portfolio quality

- Liquidity ratios

- Profitability trends over recent fiscal periods

- Non-performing assets (NPAs) and provisioning levels

Operational Efficiency and Management

The existing management team’s expertise and operational frameworks significantly influence the integration and future growth prospects of the acquired bank. Factors to assess include:

- Technology infrastructure

- Customer service quality

- Branch network and geographic reach

- Internal controls and compliance mechanisms

The Process of Acquiring International Banks for Sale

1. Market Research and Identification of Opportunities

The first step involves comprehensive market analysis to identify banks that align with the investor’s strategic goals. Specialized financial brokers, such as those at eli-deal.com, offer invaluable access to a curated list of international banks for sale, along with detailed dossiers.

2. Due Diligence and Valuation

Post-identification, due diligence plays a crucial role. It encompasses financial audits, legal compliance checks, risk assessment, and valuation modeling to determine fair market value and negotiating leverage.

3. Negotiation and Deal Structuring

Negotiation involves not only price but also terms, regulatory approvals, and transitional arrangements. Crafting a deal structure that mitigates risks and optimizes tax efficiencies is vital.

4. Regulatory Approvals and Closing

Final steps include obtaining necessary regulatory clearances in relevant jurisdictions. The process may involve submission of comprehensive documentation and time-consuming approval cycles.

5. Integration and Business Continuity

Post-acquisition, a seamless integration plan ensures operational stability, compliance adherence, and realizing synergies to maximize value creation.

Benefits of Investing in International Banks for Sale

Engaging with international banks for sale confers numerous strategic benefits, some of which are detailed below:

Access to Emerging Markets

Many banks up for sale are located in fast-growing economies like Southeast Asia, Africa, and Eastern Europe. Acquiring such institutions grants immediate access to burgeoning markets with high growth potential.

Portfolio Diversification

International banking assets diversify an investor’s portfolio, reducing exposure to domestic economic fluctuations and providing stability during regional downturns.

Enhanced Revenue Streams

Global banks often generate income from diverse sources such as cross-border transactions, international trade finance, foreign exchange, and global asset management.

Strengthening Global Presence

Owning foreign banks enhances corporate prestige and market influence, positioning investors as major players in the international banking arena.

Emerging Trends in the Market of International Banks for Sale

This sector is dynamic, influenced by global economic shifts, technological advances, and regulatory reforms. Notable trends include:

- Digital Transformation: Banks for sale are increasingly integrating fintech solutions, offering digital banking services, mobile payments, and blockchain capabilities.

- Regulatory Consolidation: Harmonization of banking standards across regions simplifies cross-border acquisitions but also necessitates compliance with multiple legal frameworks.

- Focus on Niche Markets: Institutions serving specialized sectors such as Islamic banking, microfinance, or private banking attract strategic interest.

- Private Equity and Sovereign Wealth Funds: These entities are actively seeking to acquire international banks to diversify their investment portfolios.

Why Choose eli-deal.com for Your International Banking Acquisition Needs?

As a premier marketplace and brokerage specializing in mergers, acquisitions, and high-value assets, eli-deal.com provides unique advantages to investors seeking international banks for sale:

- Comprehensive Listings: Access to exclusive opportunities and detailed dossiers on available banks worldwide.

- Expert Guidance: Experienced advisors to assist with valuation, Due Diligence, and negotiations.

- Secure Transactions: Ensuring compliance and confidentiality throughout the process for peace of mind.

- Post-Sale Support: Assistance in regulatory compliance and integration strategies after acquisition.

Conclusion: Unlocking Global Banking Opportunities in a Competitive Market

Acquiring international banks for sale is a powerful strategy for those aiming to expand their financial influence, diversify their investments, and capitalize on emerging economic opportunities. Success in this arena demands thorough research, strategic planning, and reliable partnerships. With the right approach, guided by expert insights from trusted sources like eli-deal.com, investors can unlock significant value and establish a dominant presence in the global banking landscape.

In an era where globalization defines financial prosperity, the opportunity to acquire and operate international banks is more accessible and promising than ever. Embrace these prospects, navigate the complexities with confidence, and position yourself at the forefront of international finance.